#Atiya updates

Explore tagged Tumblr posts

Text

New Series I have: Of Souls, Chalk, and Blood

A take on the DCXDP trope of the Bats being involved in a cultists' summoning. Only this time, they're too late.

This is a series based on when I responded to the Danny's Nest prompt by @cyrwrites. An awesome prompt, that if you look in the reblogs there are a bunch of cool takes by others on tumblr so be sure to check them out!!!

I posted my response with some added writing on ao3 a year ago.

BUT I recently posted a 2nd part of this series that I think will be 3 parts long.

Hope you enjoy!

67 notes

·

View notes

Text

❃ ☆ Welcome to My Blog ☆ ❃

About Me [last updated February 1, 2025]

Name: Atiya (a • tee • ya)

Pronouns: (they / them / theirs)

Age: 24

Black, nonbinary, bisexual, demisexual, AuDHD, local chronically ill and disabled baddie

My main side blog for writing or appreciating the work of others. I might just repost EXPLICIT/NSFT stuff on @educatorsareslutstoo cuz they already disabled messages and replies so itll be a spam 🤣. Will still ponder neurodivergently aloud about sex and yearn and lament about it on here ESPECIALLY bc we’re still in a panasonic. Please wear a mask and get you some tests if you're able to. @covid-safer-hotties has hella info on her blog. You should support her if you ever do some research over there.

I'm still a masked baddie but I'm not gon post too too much about it on here cuz i need people to NOT know me and connect me to other spaces. So if you think, you know me, no tf you don't!

But you gon see me yearning on here big time lustily and romantically. Enjoy the privilege.

If you know my main, no you don't please ignore (IF YOU A WRITER, YES THAT WAS ME BUT LET'S KEEP IT OUR SECRET).

Anon asks and DMs are welcome. Thinking about maybe opening up requests?

Writings So Far:

I Hope - A Terry Richmond x OC: [1] [2] [3] [4] [5] [6]

A Poem

absolution comes in the middle of the night - a poem

your ghost made a visit - a poem

I like to read, write and be very expressive. This blog is all of over the place. I hope you enjoy🥰

#slutsareteacherstoo#disabled nsft#team ‘we turn big and bad dudes into bitches (with consent!)’ reporting for duty 🫡#shoutout to my chronically ill and disabled baddies#chronically ill and disabled black hotties

1 note

·

View note

Note

i got to finally playing enstars since i think it released in my region. this game is a hazard for realsies

NO YEAH. YEAH IT IS. i literally have to put it down for days to weeks at a time so i dont continue to make my carpal tunnel worse because i end up playing for HOURS.......

oh and then you get to reading the stories. man. the psychic damage. i forgot the hardhitters in !! but even the main story is kinda like [lisa simpson meme]

#atiya tag#youre very welcome to update me as you go!!!#my tip for the actual rhythm game part is to play on 0BP and adjust your settings until it works best for you!!#also dont feel pressured to full combo on hard or expert immediately!! please dont if it hurts you is too difficult for you!!

9 notes

·

View notes

Text

State of the Galaxy. [midnightspxce]

A quick State of the Galaxy post. Probably will be updated as these stories progress, but I’ve noticed while rereading I keep assuming people know things already from my shitposts and have gained telepathy but that’s not always the truth. Kind of my own ‘Canon Defiance’, because I take canon and yank it to how I like it. If you’d like to pull any head canons on timelines or ages of canon characters, feel free to. This was kind of a passion project of mine because once I get involved in something, I get involved.

I also am horrible at remembering ages. This is as much for you, the reader, as for me, the author.

If you don’t want to read this whole mess, here’s the timeline I reference a lot. I defy it all the time and twist and turn it into what I want, but anyways. Same thing with ages of companions here.

SHADOW OF THE SITH -

In this story, the first canon defiance you’ll notice is that in-between the beginning and end of the vanilla story is two years, instead of the widely accepted three. Well, for most characters. Then there’s another year to Assault on Tython/Korriban Incursion, or Chapters 1 + 2 of Shadow of the Sith (13 ATC). As mentioned in the book, there’s another two years in between then to Shadow of Revan, which is Chapters 3-12 (15 ATC). Ziost takes place months after that, currently Chapters 13-16 (to be updated). Just after Ziost comes the first chapter of Knights of the Fallen Empire. Five years passes (20 ATC), and then there is a two year period of the expansion there (22 ATC). Another year passes to Knights of the Eternal Throne (23 ATC) A year passes to the end of Nathema (24 ATC). Another two years passes to the end of Onslaught (26 ATC). This is all subject to change because I’m kind of horrible about sticking to a timeline (and with Onslaught so far in the future of the story nothing is set in stone), but it will be updated if I change my mind.

Now, I’ve deduced there are sixteen years in between the vanilla story and the end of Onslaught. Because of this, here are the ages of both OCs currently mentioned in the story and some canon characters. You can skip this if you don’t care.

Major Characters - Tri’ama Amarillis - 20 (10 ATC - Vanilla Game), 36 (26 ATC - Onslaught) Naji Iresso - 20 (10 ATC), 36 (26 ATC) Mierrio Revel - 21 (10 ATC), 37 (26 ATC) Whyatt Grace - 19 (10 ATC), 35 (26 ATC) Dhyndre Djaal - 17 (10 ATC), 33 (26 ATC) Khaak Beniko - 28 (10 ATC), 44 (26 ATC) Ba’shira Cadera - 18 (10 ATC), 34 (26 ATC) J’nell Wryen - 40 (10 ATC), 56 (26 ATC) Khelan Hyllus - 29 (10 ATC), 45 (26 ATC) Hakiojkl Jorgan - 30 (10 ATC), 46 (26 ATC)

Minor Characters [ + mentions] - Raegia Amarillis - 50 (10 ATC), 66 (26 ATC) Yusaits Amarillis - 57 (10 ATC), 73 (26 ATC) Typarnk Amarillis - 24 (10 ATC), 40 (26 ATC) Scorvs Amarillis - 26 (10 ATC), 42 (26 ATC) Kadasha Amarillis - 17 (10 ATC), 33 (26 ATC) Bisauur Sae - 18 (10 ATC), 34 (26 ATC) Vza’haria Atiya - 35 (10 ATC), 51 (26 ATC) Jaak’lo Khethak - 27 (10 ATC), 43 (26 ATC) Synntai Pakar - 24 (10 ATC), 40 (26 ATC) Ryean Wystern - 26 (10 ATC), 42 (26 ATC) Xev’heng Lumere - 31 (10 ATC), 47 (26 ATC) Xalzon Dajev - 43 (10 ATC; deceased) Weit’hara’jel - 44 (10 ATC), 60 (26 ATC) Weit’axis’ion - 23 (10 ATC), 39 (26 ATC) Zhonani Zaares - 26 (10 ATC), 42 (26 ATC) Aethree Zaares - 27 (10 ATC), 43 (26 ATC)

Canon Characters - Theron Shan - 22 (10 ATC), 38 (26 ATC) [tbd]* Lana Beniko - 27 (10 ATC), 43 (26 ATC) [tbd]* Andronikos Revel - 34 (10 ATC), 50 (26 ATC) Malavai Quinn - 34 (10 ATC), 50 (26 ATC) Felix Iresso - 29 (10 ATC), 45 (26 ATC) Torian Cadera - 19 (10 ATC), 35 (26 ATC) Vector Hyllus - 31 (10 ATC), 47 (26 ATC) Aric Jorgan - 30 (10 ATC), 46 (26 ATC) Zenith - 34 (10 ATC), 50 (26 ATC)

All of these ages, beyond my OCs, are just speculation at the moment. Especially *Theron and Lana (I remember seeing someone assume she was fifty-ish and their reasoning made sense so if I find it again I’ll link it here), because their ages are all over the place through the fandom. Also did anyone notice that all the men are so damn old compared to where most PCs are head canoned as? Except for maybe the force blind classes, all the force users are assumed to be pretty young, like in the 18-25 range. Andronikos, Quinn, Iresso, I’m looking at ya’ll. And Zenith. He can’t be romanced in-game, but Bis was 18 in 10 ATC, and he’s assumed to be 30-40. If anyone intends to cancel me over this in the future, in my defense, I always headcanon my characters young. Not to put this all on Bioware -- but to put this all on Bioware.

SHAN -

Shan, while relatively new, is still probably one of the most solid timelines I’ve had thus far. There’s not too much canon defiance here, only that instead of two years like in Shadow of the Sith, Shan has three years for Lexulle’s class story (13 ATC). Then there’s a year to Shadow of Revan hits in 14 ATC. Lexulle has Malcom late 14 ATC, another two, nearly three years passes to early 17 ATC, which is where they are now at the beginning of Knights of the Fallen Empire. After that (22 ATC), Knights of the Fallen Empire, Knights of the Eternal Throne and the traitor arc take place over the course of about three years respectively (25 ATC). A year passes through Jedi Under Siege and Onslaught (26 ATC).

There are sixteen years in between the beginning of the game and Onslaught.

Characters: Lexulle Kallig - 22 (10 ATC), 38 (26 ATC) Malcom Kallig-Shan - 0 (14 ATC), 12 (26 ATC) Andronikos Revel - 32 (10 ATC), 48 (26 ATC) Theron Shan - 23 (10 ATC), 39 (36 ATC)*

*As always, I will eternally struggle with Theron’s age.

WHAT WE LOST IN THE FIRE -

This one. Is the bane of my existence at the moment. It’s a bit of a struggle because the main part of story, or at least the part that is a big part of the first arc takes place before the main story. Figuring that out while keeping mind of Andronikos and Mierrio’s ages was definitely a fun challenge. Andronikos and Mierrio had Corsha in 7 BTC, making him 20 and her 21. Skip forward nearly a decade to Shadow Of Revan/Ziost (16 ATC), which is actually on par with the SWTOR timeline. Kind of. Five years forward to her unfreezing in carbonite (21 ATC). After that it should follow the sort of official timeline, three years from then to the traitor arc (24 ATC).

There are fourteen years in between the beginning of the game and Onslaught.

Characters: Corsha Revel-Kallig - 17 (10 ATC), 31 (24 ATC) Koth Vortena - 28 (10 ATC), 42 (24 ATC)* Andronikos Revel - 38 (10 ATC), 52 (24 ATC) Mierrio Andeyr - 39 (10 ATC), 53 (24 ATC)

*Bioware. Really. I know Corsha is aged down pretty far compared to my average quizzy (20-24), but even so he’s still so OLD compared any force sensitive class I personally head canon. I even aged him down six years compared to the guide I found and he’s still almost a decade older than her.

These are all just my own personal headcanons for the expansions, not at all to be taken as canon unless you’d like it for your own stories. I do not see how realistically they managed to to shove all of this into their arbitrary thirteen years between the vanilla story and the end of Onslaught but I choose to defy canon at the moment. I love the writers, I really do, but why are all my male love interests a decade+ older than my characters?

5 notes

·

View notes

Photo

#syingertattoos 🔥 || #atiya #mom #love || 📞CONTACT FOR APPOINTMENT: | 03160141165 | 👍 like our facebook page & follow 👉 @syinger_tattoos to get regular updates https://web.facebook.com/syingertattoos . . . . . . #tattoo #tattoos #ink #inked #art #tattooed #tattooartist #tattooart #tattoolife #instagood #tattooist #tattooing #tattooer #instatattoo #artwork #inklovers #tattoodesign #tattoolove #tattoo2me #style #fashion #lahore #instagram #pakistan #tattoosinlahore #tattoosinpakistan (at SyingeR Tattoos) https://www.instagram.com/p/B2TZVJ-BiE2/?igshid=l84w8eeybxwc

#syingertattoos#atiya#mom#love#tattoo#tattoos#ink#inked#art#tattooed#tattooartist#tattooart#tattoolife#instagood#tattooist#tattooing#tattooer#instatattoo#artwork#inklovers#tattoodesign#tattoolove#tattoo2me#style#fashion#lahore#instagram#pakistan#tattoosinlahore#tattoosinpakistan

1 note

·

View note

Photo

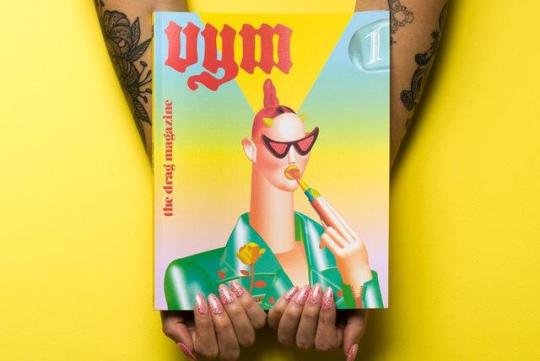

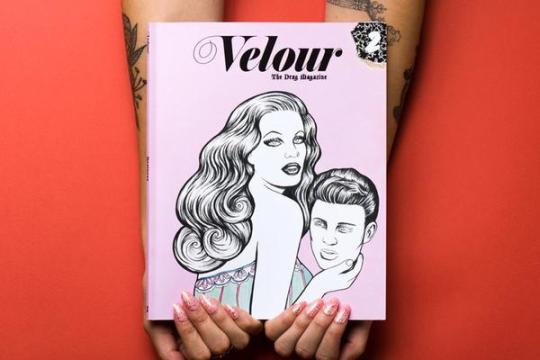

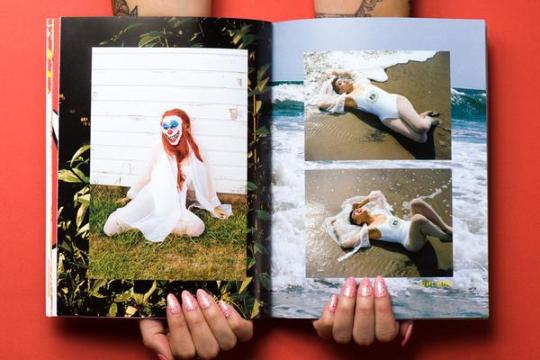

VELOUR: The Drag Magazine is FREE to read this week!

Sasha Velour (Artistic Director) and Johnny Velour (Editorial Director) have put all three issues of @thedragmagazine up on their website to read for FREE for a limited time “to celebrate the entire community of drag”!

These are such amazing collaborative collections of art & writing celebrating drag in all forms, and I'm not just saying that because I have something in every issue :P The Velours are fantastic curators & hosts to a range of brilliant creators of all genders & backgrounds, and I’m truly honored to be a part of it. Each issue is packed with goodness: photography, illustrations, collaborative collage (with thread, gold leaf, plastic pony beads, sequins), poetry, interviews, essays, conversations, and comics (like mine!). Read more about each issue and the above photos under the cut, and...

Update (2020): VELOUR is no longer available to read online for free, but you can learn more about the collected hardcover here.

VELOUR #1 (fka VYM): What Is Drag?

For our inaugural issue, we asked over 20 of the most talented independent artists, performers, and writers around to define the indefinable: "What is Drag?" Their answers are as varied and valid as the art itself and their work reminds us that their is no "right way" to do, or to even define drag. VYM seeks to celebrate it all. Cover by John Lisle, book photos by Andrew Atiya, Hands by Miss Malice. Pictured pages by 1) Donald C. Shorter Jr, photos by Yuki Matsumura, 2) Sonnet by Wo Chan, illustration by Sasha Velour, and 3) Photos by Jesus Ward, embroidery by Ritsu Hirayama, drag designs by Sasha Velour, models Sydney (left) and Dionne (right).

VELOUR #2: Realness

For our second issue (newly re-named "Velour"), we explored the history and meaning of "realness" — from gender illusionists and the Harlem ball scene to the "real" and surreal drag arts of today. Drag, it seems, is both imitation and transformation, performance and truth. The diverse body of work, by over 25 artists, explores the ways in which drag utilizes "the real" for radical thought and self-expression. Cover by Sophie McMahan, book photos by Andrew Atiya, Hands by Miss Malice. Pictured pages by 1) Patrick Arias (photographer) and Pearl Harbor (model), 2) Conversation by Miss Malice, Nyx Nocturne, Pearl Harbor, and Lady Quesa’Dilla, photos by Elisabeth Fuchsia and Roberto Rischmaui.

VELOUR #3: Sister

Velour's third issue is dedicated to drag families, specifically the powerful relationships that drag performers form with each other as they develop characters, style, and careers. Over 50 artists contributed to this issue, ranging from Sisters of Perpetual Indulgence in Boston to the queens of Rupaul's Drag Race Season 9, from contemporary Art Drag in Chicago to Kansas City queens of the late 50s...and far beyond! This highly visual issue is a love letter to queer creativity, community, and the excellence of drag. Cover by David Ayllon, Kelsey Short, Rumi Hara, and Sasha Velour.

Go to Sasha’s website to learn more!

89 notes

·

View notes

Text

Nollywood Stars Who Have Died In 2020 (Photos)

Here are Nollywood stars, who have passed away in 2020, from different tribes and sectors of the movie industry.

Nollywood started recording the deaths of its practitioners in 2020 with the death of actress Jennifer Omole who passed away on January 3, 2020.

Here are Nollywood stars, who have passed away in 2020, from different tribes and sectors of the movie industry.

Jennifer Omole

Nigerian actress, Jennifer Omole, passed on in Spain on 3rd January 2020, at the age of 33. She was buried the following evening at Villarejo de Salvanes, Madrid.

The sad news about Jennifer’s death was shared by her close friend and colleague, Uche Ogbodo, on Instagram.

Omole was a member of the Actors Guild of Nigeria, Spain chapter, where she was based although her friends revealed that she recently moved to the United Kingdom. She hailed from Edo State.

Before her death, Jennifer was a movie producer and CEO of JennisFilms Production Ltd. She produced “Stolen Vow” alongside Uche Ogbodo, Jibola Dabo, Daniel Lloyd and a host of other Nollywood actors.

“Stolen Vow” had UK, Spain, and Switzerland premieres with Uche Ogbodo and the late actress as executive producers.

Toyosi Arigbabuwo

Ace Yoruba actor, Toyosi Arigbabuwo, died January 13, 2020, at his residence in Ibadan, the Oyo state capital, after battling an undisclosed illness for six months.

Arigbabuwo was a veteran actor who featured in many Yoruba movies including Ogborielemosho and Bashorun Gaa, Odun Baku.

He had dedicated his life to the promotion of Islamic religion, especially in Ido local government area where he lived until his death. He was the PRO of the Muslim community in Apete-Awotan-Ayegun and environs in Oyo state.

The chairman of the Muslim Community in Apete-Awotan-Ayegun and environs, Abdulwaheed Amoo, confirmed his death and burial on January 14, 2020.

Frank Dallas

The veteran Nollywood actor and production manager, Frank Dallas died on 19th February 2020 after suffering cardiac arrest in his hotel room.

The actor who was popularly known as “Adedibu” or “Killer” in movies reportedly died in Umuahia, Abia State while attending a summit.

The deceased, who hailed from Ohafia in Abia State was the former public relations officer of the Actors Guild of Nigeria (AGN), Lagos chapter.

Monalisa Chinda-Coker defeated him to emerge AGN national PRO in an election held in 2019.

Dallas, who was renowned for his action roles in Nollywood movies, began his acting career in the early 90s. He often starred alongside Jim Iyke and Hanks Anuku in movies.

Some movies he featured include ‘Emotional Pains’, ‘A Night to Remember’, ‘Back II Back’, ‘Blind Love’, ‘Sweet Love’ and ‘Hit The Street’.

Pa Kasunmu

Veteran Nollywood actor, Kayode Odumosu, popularly known as Pa Kasumu died on the 1st of March 2020, after a prolonged battle with heart failure.

The renowned thespian died in a private hospital in Lantoro, Abeokuta in Ogun State.

Born Ilesanmi Olukayode Olugbenga Odumosu in Ibadan on March 16, 1953, the 66-year-old veteran began acting as a teenager. His debut role was in 1968 in a stage play ‘Iyawo Orun’. In 1969, he featured in his breakout play titled ‘Omo Ekere’.

Pa Kasumu was a household name in the Yoruba movie industry until he went off radar when he was down with Biventricular Heart Failure in 2013.

In an interview with The Punch in December 2019, Pa Kasumu said that his sickness was of a spiritual nature.

The popular Yoruba actor said all he needed are fervent prayers and not financial aid from well-wishers and well-meaning Nigerians.

He said, “The doctors are just saying their own. They said I had a partial stroke. It affected my left side and to some extent, my sight”. In 2017, Pa Kasumu’s health worsened after he got back from a medical trip to India.

In 2016, the actor’s condition became so serious that members of his family moved him from his home in Abeokuta to his elder sister’s residence at Aseese, an Ogun community situated off the Lagos-Ibadan Expressway.

Odumosu admitted that his health worsened shortly after returning from India, where he had gone to receive treatment for a heart-related ailment that also affected his eyesight and memory, in 2015.

Some of his memorable works include Babie Á (2003), Jesu Mushin (2002) and Sàngó: The Legendary African King (1998).

Gbenga Ajumoko

Veteran Yoruba filmmaker and actor, Gbenga Ajumoko died on the 22nd March 2020, after battling with a chronic ailment.

The actor cum scriptwriter was reported to be critically down with a chronic ailment since last year.

For over 6 months, Ajumoko was in a hospital in Sagamu Remo where he was diagnosed with Diabetes and Hypertension.

He solely treated the ailments quietly until things got worsen for him. He was later transferred to a private hospital located at Ibadan Garage, Ijebu Ode, Ogun State, where he died.

Ajumoko worked as a production manager, actor, writer, and movie director before he died. Some of his works include, known Enikeji (2017), Agbere (2017), Yeye Efun, Wound (2019), Ako Okuta (2018).

Alkali Matt

Nollywood actor, Alkali Matt, popularly known as Dareng, died while filming on set on 24 March 2020.

Dimbo Atiya who shared the news of his demise on Facebook said Matt passed on at around 7 pm “suddenly while he was filming on a set for an epic movie in a village near Keffi.”

Matt is popular for his role as Dareng in the African Magic series “Halita.”

However, controversial journalist, Kemi Olunloyo claimed the actor died because he had contact with someone who tested positive for Coronavirus at the AMVCA 7.

Yomi Obileye

Veteran Nollywood actor, Yomi Obileye died on Friday morning of April 24th, 2020 from an undisclosed ailment.

Obileye was known for Tade Ogidan’s movie, ‘Hostages’ in 1997, and ‘Palace’, a soap opera which featured Liz Benson, Jide Kosoko, Antar Laniyan, Dayo Adeneye, Jide Alabi, Tunji Bamishigbin.

His death was announced by Nigerian actor and comedian, Gbenga Adeyinka.

Obileye was the elder brother to Taiwo Obileye broadcaster cum actor, known for Chief Daddy (2018) and Tales of Eve: Thanks for Coming (2015).

Obileye played the father’s role to Nollywood actress, Funlola Aofiyebi in Palace opera.

Palace, one of the major Nigerian soap operas that dominated the airwaves in the 90s depicted the life of affluence of rich families and the many challenges they faced in keeping up with their status, managing their affairs, and making sure they stay on top.

Palace was aired on Africa Independent Television and directed by Tunji Bamishigbin and his co-producer, veteran TV director cum producer, Ralph Nwadike.

Chizobah Bosha Sam-Boye

Nollywood veteran actress, Chizoba Bosah Sam-Boye popular for her role in Mnet drama series, ‘Tinsel’ as ‘Aunty Abike’ died on Sunday, May 10, 2020, after a long battle with diabetes, stroke and high blood pressure.

Chizoba, who was also a filmmaker and presenter died at the age of 52.

The deceased was married to Sam Boye, and they jointly operated a company called Purple Pictures.

The deceased was a strong advocate for Nollywood Igbo, and would be remembered for her pioneering role in ‘Living in Bondage,’ ‘Checkmate,’ ‘Scandals,’ and others.

Emilia Dike

Nollywood actress Emilia Dike died on Wednesday, 21st of April, 2020 in Enugu.

According to Okechukwu Oku, who announced her death, the actress slumped and died.

Oku, who is a movie director broke the news on his Instagram page and lamented why death is so cruel taking good people away.

Popular actress, Uche Ogbodo, also expressed shock over Dike’s passage.

“Pls what happened to her, I have an Unfinished project with her oooo , Jesus Christ . Pls what happened?”, she wrote.

Dike featured in Nollywood movies such as “Ignorant couples”, “Dust of yesterday”, “Kings Guard”, “Where Money Never Sleep 1 and 2”, and many more

Femi Oyewumi (Laditi)

Popular Yoruba actor, Prince Femi Oyewumi, known as Laditi, died on Friday, 23rd of May, 2020, after he was rushed to the hospital on the previous night.

The 51-year-old prince of Soun of Ogbomoso was said to have been suffering from chronic back pain for some months before his death.

Those who watched him in the epics like Ayetoto; Koto Orun; Ija Eleye and so on won’t find it hard to remember a character called Laditi and his brilliant roles in the film industry.

Femi Oyewumi, an actor and a producer who is a specialist in a stage play, epic, and historic film, started his career in the ’80s.

Ogunojalu Ogbomoso was his last work.

However, Ajoke Kosemani, a Nollywood actress close to the actor, described his demise as a great loss to the movie industry in Nigeria.

***

Source: PM News

Kindly Share this Post using the Share Tab below and follow all our Social Media Handles to Keep up with Our Daily News Update.

Click to Follow us on Facebook

Click to follow us on Instagram

Click to follow us on Twitter

Donate to help us Grow via Blogger https://ift.tt/3gDP8Ez

0 notes

Photo

If I ever published anything that could be described as “fluff”, it was @northern--song possessing my body to force me to write it!

“gets on my knees and apologizes to anyone who speaks [language]”: My main offender of this is to the Arabic language. I know nothing of Arabic, but I tend to use Arabic names a lot because they’re pretty. I also know that for an Overwatch rp I am 80% sure I used a few languages in there that I poorly translated. “no beta we die like men”: north is my beta and I thank her so much for that “a title in lowercase (and then some)”: not in anything published, but I have a few non-published fics that did that. “still has to copy paste the code for embedding a link”: it’s very hard to remember the html for that. “ANGST”: I am literally 100% angst fic. There is nothing wholesome here. Pathia is legitimately just 100% angst because Cynthia is a fucking idiot who keeps getting injured in canon. “this pairing will never be canon but by god I will not cease”: Well, I definitely was not expecting Pathia to be a canon thing, and there’s a few OC ships I also have that I fucking wish would happen but I’m a coward sometimes. Jiro/Atiya and Merlil/Dude (whoops it’s me and the same player) being main examples. I don’t write fics for actual fandoms anymore, but if I did, I’d probably write BeauJester (Critical Role), Tallstar/Jake (Warriors), and Boomer (HLVRAI). “hozier lyric song title”: I haven’t done this yet. I am shocked that I haven’t. “do not and will not ever understand what work skins are”: I understand what they are, but I just prefer simple dark mode, thank you. “soulmate AU”: ... and they were soulmates... “could not write smut to save their lives”: I legitimately tried. But again. I am a being of pure angst. “learned html because of writing fic”: Well, I learned basic HTML. However, don’t expect me to be able to make a website or something. “kudos? comment?”: I actively seek validation. “I’m filling this out instead of working on a WIP”: (looks nervously at AAF and MoV) “Chapters: [49/?]”: I did this years ago with two different series, but now at most, my fics have eight chapters (Pyra’s Fire and A Story to Remember were 18 and 13 chapters respectively, whereas “The Calamity Named Insomnia” was 5 chapters and An Angel’s Fall will be 8 chapters). “without my beta this would be unreadable”: bLESS YOU NORTH FOR GIVING ME FEEDBACK, THE ONLY FIC YOU DIDNT BETA IS THE ONE THATS MY LEAST FAVE NOW. “Updated: 2012-02-01″: I mainly consider WIPs here with this one, mainly because I think the last time I touch AAF was a solid year ago. “no plot brain empty”: If I don’t have plot, I will die. “has written smut and has no fear”: I have all of the fear. “[Updates chapter] / [instantly checks inbox]:” I actively seek validation. “Tooth-rotting fluff”: North called my attempts at sweet fluff a “fuzzy potato”. I agree with her. “what do you mean *I* have to write the next chapter?”: “What do you mean I am one of two people who writes for this ship?” “schedule schmedule”: I could barely prevent myself from dumping all of “Calamity Named Insomnia” in one day. I prefer to dump everything all at once and then run off into my inbox. “gratuitous googling”: I remember four cases right off my head where I spent hours researching things on Google: chlorine gas, The Black Forest, mountain climates (on two separate occasions), and the average depth of a lake in Colorado. “nonexistent understanding of medicine”: As someone who writes so much injury fics, hospital AUs, and angst, you’d think I would learn by now. However, I still have no clue what I’m doing. Half of the time, I get away with it with magical healing.

yes i made this because I didn’t want to work on a WIP

9K notes

·

View notes

Text

Just posted chapter 15!

53 notes

·

View notes

Photo

BLISS Meadows “Baltimore Living in Sustainable Simplicity” is a quarter-acre vegetable plot in a meadow in Frankford, but its founders plan to expand the garden and create an educational center and agricultural green space to connect the African-American community to the land.⠀ ⠀ #BelieveInBLISS⠀ ⠀ More from a recent @baltimoresun article: “Tucked between rows of brick homes in Northeast Baltimore, Atiya Wells discovered an extraordinary place.

The budding naturalist was driving around her neighborhood in February 2018 when she stumbled upon a vacant lot bursting with flora and fauna on Plainfield Avenue in Frankford. Wells spotted a red fox slinking through the unruly tangle of trees, grasses and bushes. She was enchanted.⠀

Her search for the owner of the lot led to a partnership that has resulted in a community farm on the 2½-acre tract where Wells and a small team of volunteers grow sweet peppers, tomatoes, squash and more. But Wells has a loftier goal — to transform the property called BLISS Meadows into an educational center that, in part, will teach about the troubled and triumphant agricultural history of African Americans.”⠀ ⠀ Read more of the article at the link in my bio and check out BLISS Meadows and @backyard_basecamp on Facebook for updates on the project! 🍅🥦🌶🥬⠀ ⠀ 📸: @baltimoresun ⠀ ⠀ ⠀ ✨There’s magic here ✨⠀ ⠀ ⠀ xoxo⠀ ⠀ ⠀ #lifeissweetinthenortheast #northeastbaltimore #mybmore #mybaltimore #baltimore #iheartcitylife #visitbaltimore #thebmorecreatives #baltimorecity #baltimoremd #bmorelocal #igbaltimore #charmcity #maryland #mdinfocus #bmoresecretspots #igbmore #explorebaltimore #bmorelove #discovercharmcity #walkwithlocals #ilovebaltimore #visitmaryland #bmorelife #bmorecity #bmoreadventurous #bmoredaily #baltimorelove (at BLISS Meadows) https://www.instagram.com/p/B4M46JjJ4yD/?igshid=s649t2feb12y

#believeinbliss#lifeissweetinthenortheast#northeastbaltimore#mybmore#mybaltimore#baltimore#iheartcitylife#visitbaltimore#thebmorecreatives#baltimorecity#baltimoremd#bmorelocal#igbaltimore#charmcity#maryland#mdinfocus#bmoresecretspots#igbmore#explorebaltimore#bmorelove#discovercharmcity#walkwithlocals#ilovebaltimore#visitmaryland#bmorelife#bmorecity#bmoreadventurous#bmoredaily#baltimorelove

0 notes

Text

firstpage - bio - roundup:

sonus - fine, edit relationships

asper - fine, add outlook, edit relationships

doyen - fine

charlemagne - old format, fine for now

aachen - old format, fine for now

pax - written, needs updating / reformatting

ruodhaid - reformatted, needs updating

amaudru - perfect. love my boy

adeltrude - unwritten, needs short bio (atiya base)

amaranth - halfwritten, needs short bio (atiya base)

atiya - perfect doghtor

motya - halfwritten, needs short bio (ab)

zaha - unwritten, needs short bio (ab)

alcyone - ????????

braeburn - written, needs short bio reformat (ab)

armando - needs reformatting, halfwritten (long base)

fennel - halfwritten, needs short bio (ab)

alesandre - old format, needs reformatting, updating

sam - old format, fine for now

solsun - unwritten, needs short bio (ab)

3 notes

·

View notes

Text

About Me [last updated November 21, 2024 @ 7:27PM]

Name: Atiya (a • tee • ya)

Pronouns: (they / them / theirs)

Age: 24

Black, nonbinary, bisexual, demisexual, AuDHD, local chronically ill and disabled baddie

Side blog for NSFW stuff and writing or appreciating the work of others. This really is the main side blog. I might just repost EXPLICIT/NSFT stuff on @educatorsareslutstoo cuz they already disabled messages and replies so itll be a spam 🤣. Will still ponder neurodivergently aloud about sex and yearn and lament about it on here ESPECIALLY bc we’re still in a panasonic. Please wear a mask and get you some tests. @covid-safer-hotties has hella info on her blog. You should support her if you ever do some research over there.

DO NOT DM ME EXPECTING NSFT INTERACTIONS OFF TOP. YOU WILL BE BLOCKED! DONT PLAY WITH ME!

I'm a covid-safe baddie but I'm not gon post too too much about it on here cuz i need people to NOT know me and connect me to other spaces. So if you think, you know me, no tf you don't!

But you gon see me yearning on here big time lustily and romantically. Enjoy the privilege.

If you know my main, no you don't please ignore (IF YOU A WRITER, YES THAT WAS ME BUT LET'S KEEP IT OUR SECRET).

Anon asks and DMs are welcome. Thinking about maybe opening up requests, but TBD chile, let's see after I submit these apps.

Writings So Far:

I Hope Part 1

I Hope Part 2

I Hope Part 3

I Hope Part 4

I Hope Part 5

A Poem

absolution comes in the middle of the night - a poem

Haunt Part 1 of 2

Haunt Part 2 of 2

your ghost made visit - a poem

They coming for my OG alt it seems like so im creating this backup just in case…🫣🫣

#slutsareteacherstoo#educatorsareslutstoo#disabled nsft#team ‘we turn big and bad dudes into bitches’ reporting for duty 🫡#shoutout to my chronically ill and disabled baddies#chronically ill and disabled black hotties

17 notes

·

View notes

Photo

🖤 #skulls — Our elegant themed @stereohype (set of 7) Button Badge Gift Box is now available again in an updated second version. https://www.stereohype.com/221-skulls It contains our seven most popular skull artworks selected from #stereohype’s 1465-strong badge collection. — #skull #buttonbadge #buttonbadges #punk #goth #youth #indie #alternative #love #music #minimal #newwave #darkwave #shoegaze #bacon #fashion #morbid #melancholic #melancholy #rebel #dark #black #blackhearted #stbbdc #stbio2 #stbio3 #stbio6 #stbio7 | — USOTA taken from Stereohype's B.I.O. (By Invitation Only) Series 7, Fay Newman from Competition Winners 2010, French from B.I.O. Series 3, 123klan from B.I.O. Series 2, TwoPoints from B.I.O. Series 6, Ciarán Meister from Competition Winners 2016 and Atiya Batts from Competition Winners 2018. | — Link via @stereohype profile. (Homepage > Gift Box section or Search By Theme: Skulls) https://www.instagram.com/stereohype/p/BwPtdl6hz9Y/

0 notes

Text

ABB: Shaping a leader focused in digital industries

ZURICH — Fundamental actions to focus, simplify and lead in digital industries for enhanced customer value and shareholder returns

Focus of portfolio on digital industries through divestment of Power Grids

Divestment of Power Grids to Hitachi expands existing partnership and strengthens Power Grids as a global infrastructure leader with enhanced access to markets and financing

Enterprise Value of $11 billion for 100% of Power Grids, equivalent to an EV/op. EBITA multiple of 11.2x1

Crystallizing value from the transformation of Power Grids including doubling operational EBITA margin since 20142

ABB initially to retain 19.9 percent in the equity of carved-out Power Grids to ensure transition; pre-defined exit option on 19.9 percent equity at fair market value with floor price at 90 percent of agreed Enterprise Value, exercisable by ABB three years after closing

Closing expected by first half of 20203

ABB intends to return 100% of the estimated net cash proceeds of $7.6-7.8 billion4 from the 80.1% sale to shareholders in an expeditious and efficient manner through share buyback or similar mechanism

Simplification of business model and structure

Discontinuation of legacy matrix structure

Businesses will run all customer-facing activities as well as business functions and territories, fostering ABB’s entrepreneurial business culture

Businesses to be strengthened by transfer of experienced country management resources

Existing country and regional structures including regional Executive Committee roles to be discontinued after closing of the transaction

Corporate activities to be focused on Group strategy, portfolio and performance management, capital allocation, core technologies and ABB Ability™ platform

Shape four leading businesses aligned with customer patterns

All businesses global #1 or #2 in attractive growth markets:

Electrification led by Tarak Mehta

Industrial Automation led by Peter Terwiesch

Robotics & Discrete Automation, a unique combination of B&R and Robotics, led by Sami Atiya

Motion, combining ABB’s market-leading offering in motors and drives, led by Morten Wierod, appointed to Executive Committee as of April 1, 2019

ABB Ability™ tailored digital solutions will drive customer value in each business whilst capturing synergies through common platform

Actions position ABB with a leadership role in digital solutions, and evolving technologies such as artificial intelligence

Financial impact of new ABB

$500 million annual run-rate cost reductions across the group

Approx. $500 million non-operational restructuring charges

New financial framework post-closing defined

New group target framework

Capital allocation priorities unchanged

Dividend policy of rising sustainable dividend per share

ABB intends to maintain the level of dividend per share post close

ABB intends to maintain its long-term “single A” credit rating

Business targets and further financials to be disclosed with strategy update

Strategy update on February 28, 2019, in combination with the Q4 and Full Year 2018 results to provide further details on ABB’s new strategy, businesses and financials

“ABB has been driving industrial change for more than a century as a global pioneering technology leader. As a result of our Next Level strategy, all of our businesses are today number 1 or 2 in their respective markets. To support our customers in a world of unprecedented technological change and digitalization, we must focus, simplify and shape our business for leadership. Today’s actions will create a new ABB, a leader focused in digital industries,” said ABB CEO, Ulrich Spiesshofer.

“Power Grids will strengthen Hitachi as global leader in energy infrastructure and Hitachi will strengthen Power Grids’ position as a global leader in power grids. With this transaction, we are realizing the value we have built through the transformation of Power Grids over the last four years. Our shareholders will directly benefit through the return of the proceeds of the divestment. Building on our existing partnership announced in 2014, the initial joint venture will provide continuity for customers and our global team.”

“To compete in today’s fast-changing world, we fully empower our businesses, through the discontinuation of the legacy matrix structure ensuring zero-distance to customers and increasing our agility in decision-making. Our four newly shaped businesses, each a global leader, will be well aligned to the way our customers operate and focus stronger on emerging technologies such as artificial intelligence. The continued simplification of our business model and structure will be a catalyst for growth and efficiency in our businesses. Our businesses will be further supported through the transfer of experienced resources from today’s country organizations.”

“All of this will only be possible due to the commitment of our global team who has made ABB what it is today. Our innovation power together with our inclusive culture will continue to be a differentiating strength of our company. We will live enhanced customer focus, provide attractive opportunities for our employees and deliver value for shareholders.”

Peter Voser, Chairman of ABB, said, “Today´s announcement marks the beginning of a new chapter in ABB´s history. Building on our technology and global talented employee base we will further strengthen our focus in digital industries, delivering competitive returns for shareholders, including our committed dividend policy. Over the past five years the deliberate execution of ABB’s strategy laid the foundation for our businesses to compete in the fast changing digital industries and deliver profitable growth.”

“We were very clear in the past that the actions required for the turnaround of Power Grids could be best achieved within ABB. Following completion of this step, we undertook a review of the Power Grids business and decided to secure the best home for the future development of the business through the combination with Hitachi. The new ABB will be positioned to write the future as a customer focused technology leader in digital industries.”

Focus of portfolio on digital industries through divestment of Power Grids

ABB announces today that Hitachi will acquire ABB’s Power Grids business, an expansion of its existing partnership with Hitachi. The agreed price represents a transaction Enterprise Value of $11 billion for 100 percent of Power Grids, the equivalent to an EV/op. EBITA multiple of 11.2x1, before share of corporate cost. ABB will initially realize a levered consideration of ~$9.1 billion from the sale of 80.1 percent of Power Grids, including pre-sale net leverage (intercompany loan net of cash transferred), before one-time transaction and separation related costs as well as cash tax impacts.

In the fast-changing world of energy infrastructure, with a shifting customer landscape and the need for financing and increased government influence, ABB believes Hitachi is the best owner for Power Grids. As a stable and long-term committed owner, with whom ABB has developed a strong business partnership since 2014, Hitachi will further strengthen the business, providing it with access to new and growing markets as well as financing. Hitachi will accelerate Power Grids to the next stage of its development, building on the solid foundation achieved under ABB’s previous ownership.

Since 2014, Power Grids has been significantly improved under the ownership of ABB. The latest results (Q3 2018) are at the target margin corridor, having more than doubled margins, with positive third party base order development recorded for the last six consecutive quarters.

ABB will initially retain a 19.9 percent equity stake in the joint venture, allowing a seamless transition. The transaction agreement includes a pre-defined option for ABB to exit the retained 19.9 percent share, exercisable three years after closing, at fair market value with floor price at 90 percent of agreed Enterprise Value. Hitachi holds a call option over the remaining 19.9 percent share at fair market value with floor price at 100 percent of agreed Enterprise Value.

The joint venture will be headquartered in Switzerland, with Hitachi retaining the management team to ensure business continuity.

Starting in Q4 2018 until closing, ABB will report Power Grids in discontinued operations. As a consequence, ABB will record $350-400 million of stranded and other carve-out related costs, which are currently predominately recorded as part of the Power Grids cost base. These will now be recognized in ABB’s corporate & other operational EBITA. ABB expects to eliminate the vast majority of these costs by deal closing by transferring them back to Power Grids. ABB expects approximately $200 million of charges in Q4 2018 related predominantly to the legacy EPC substation business reported in non-core corporate & other operational EBITA.

ABB expects to incur one-time non-operational transaction and separation related costs of $500-600 million. ABB anticipates $800-900 million related cash tax impact. The completion of the transaction is expected by first half of 2020, subject to regulatory approvals and fulfillment of closing conditions. ABB intends to return 100 percent of the estimated net cash proceeds of $7.6-7.8 billion5 from the 80.1 percent sale to shareholders in an expeditious and efficient manner through share buyback or similar mechanism.

Simplification of business model and structure

Effective April 1, 2019, ABB will simplify its organizational structure through discontinuation of the legacy matrix structure, thereby empowering its four leading businesses to serve customers even better, while further sharpening responsibilities and increasing efficiency.

ABB’s new organization will provide each business with full operational ownership of products, functions, R&D and territories. The businesses will be the single interface to customers, maximizing proximity and speed.

The corporate center will be further streamlined. It will set the long-term vision and strategy for the group, guided by ABB’s values. It will drive capital allocation, portfolio and performance management, core technologies ABB Ability™, ABB’s brand and investment in people. As a key building block of the simplification, existing country and regional structures including regional Executive Committee roles will be discontinued after the closing of the transaction. Existing resources from country level will strengthen the new businesses. ABB expects a total of $500 million annual run-rate cost reductions across the group over the medium-term. Approximately $500 million of related non-operational restructuring charges are expected to be taken over the coming two years.

Shape four leading businesses aligned with customer patterns

ABB will shape four customer-focused, entrepreneurial businesses – Electrification, Industrial Automation, Robotics & Discrete Automation and Motion. Each business will be either the global #1 or #2 player in attractive markets with strong secular drivers. ABB’s established domain know-how, world-class engineering and technology expertise, will position the four businesses well to deliver innovative products and solutions for enhanced customer value. ABB’s addressable market is growing by 3.5-4 percent per annum, adding $140 billion in size to reach $550 billion by 2025.

Based on ABB’s common digital platform ABB Ability™, the businesses will provide tailored digital solutions, driving enhanced customer value. Building on emerging technologies including artificial intelligence and its strong software offering, ABB Ability™ will meet the increasing demand from ABB’s customers for digital solutions in the rapidly changing industrial world.

Electrification – writing the future of safe, smart and sustainable electrification

The existing business will provide a complete portfolio of innovative products, digital solutions and services from substation to socket. With a #2 market position globally, its addressable market is presently $160 billion and will grow on average around 3 percent per annum over the long-term. The Electrification business will have strong exposure to rapidly growing customer segments including renewables, e-mobility, data centers and smart buildings. The business will be led by Tarak Mehta, currently president of the Electrification Product division. The Electrification business would have generated approximately $13 billion of revenues in the twelve-month period to end September 2018, including an estimated revenue contribution across the period from GEIS, a business that was acquired June 30, 2018.

Industrial Automation – writing the future of safe and smart operations

The newly shaped business will offer a complete range of innovative solutions enabling customers to operate safe and energy-efficient processes with increasing autonomy. Industrial Automation will include ABB’s industry-specific integrated automation, electrification and digital solutions, control technologies, software and advanced services, as well as measurement & analytics, marine, and turbo-charging offerings. Industrial Automation will be #2 in the market globally. The addressable market of $90 billion is expected to grow on average by 3-4 percent per annum over the long-term. The business will be led by Peter Terwiesch, currently president of the Industrial Automation division. Industrial Automation would have generated approximately $7 billion of revenues in the twelve-month period to end September 2018.

Robotics & Discrete Automation – writing the future of flexible manufacturing and smart machines

The newly shaped business will uniquely combine machine and factory automation solutions, mainly from B&R, with the most comprehensive robotics solutions and applications suite in the market. The business will be #2 globally, with a #1 position in robotics in the important, high-growth Chinese market. The addressable market, already $80 billion in size, is anticipated to grow on average at 6-7 percent per annum over the long-term. The businesses digital solutions and services provide customers with enhanced safety, efficiency, up-time and speed, and cater to the growing customer demand for flexible and integrated manufacturing solutions. Robotics & Discrete Automation will be led by Sami Atiya, currently president of the Robotics and Motion division. Robotics & Discrete Automation would have generated approximately $4 billion of revenues in the twelve-month period to end September 2018.

Motion – writing the future of smart motion.

The business will provide customers with a comprehensive range of innovative electrical motors, generators, drives, and service, as well as integrated digital powertrain solutions. Motion will be the #1 player in the market globally, with the largest installed base in an $80 billion market that grows on average around 3 percent per annum. The business will be led by Morten Wierod, currently Managing Director Business Unit Drives. He will become a member of the Executive Committee effective

April 1, 2019. Motion would have generated approximately $6 billion of revenues in the twelve-month period to end September 2018.

Attractive financial profile

ABB will demonstrate improved commercial quality of business, enhanced exposure to faster growing markets, with a greater emphasis on high value-add solutions, less large order volatility and more recurrent revenues through digital solutions, software and services.

ABB’s investment proposition is reflected in a new medium-term group target framework:

3-6 percent annual comparable revenue growth

operational EBITA margin of 13-16 percent

Return on Capital Employed (ROCE) of 15-20 percent

Cash conversion to net income of approximately 100 percent, and

Basic EPS growth above revenue growth

ABB would have generated revenues of approximately $29 billion in the twelve-month period to end September 2018, including an estimated revenue contribution across the period from GEIS, a business that was acquired June 30, 2018, and excluding Power Grids contribution.

Capital allocation

ABB’s sustained capital allocation priorities are unchanged, namely:

fund organic growth, R&D and capex to yield attractive returns

rising sustainable dividend

value-creating acquisitions

returning additional cash to shareholders

Following completion of the divestment of Power Grids, ABB intends to return 100 percent of the net cash proceeds6 to shareholders in an expeditious and efficient manner and execute a policy of a rising sustainable dividend. ABB intends to maintain the level of dividend per share post close and aims to maintain its “single A” credit rating long term.

Strategy update

ABB intends to host a strategy update alongside the Q4 2018 results. At the strategy update, ABB’s leaders and management teams of the four business areas will provide detailed overviews of their markets, strategies, businesses and targets.

Revised dates

In light of these fundamental changes, ABB will amend the announced dates for:

Q4 and FY 2018 results to February 28, 2019

Q1 2019 and the AGM to May 2, 2019

Credit Suisse AG and Dyal Co. LLC acted as financial advisors, and Freshfields Bruckhaus Deringer LLP as legal advisors, to ABB.

More information

For further information on today’s announcement, please see ABB.com/writing-the-future.

ABB will host a press conference today starting at 10:00 a.m. Central European Time (CET) (9:00 a.m. BST, 4:00 a.m. EDT). The event will be accessible by webcast on https://swisscomstream.ch/abb/20181217/en

ABB will host a conference call for analysts and investors, starting at 2:00 p.m. Central European Time (CET) (1:00 p.m. GMT, 8:00 a.m. EST). The call will be available to join via webcast https://swisscomstream.ch/abb/20181217/en

The event will be accessible by conference call. Callers are requested to phone in 10 minutes before the start of the call. The analyst and investor conference call dial-in numbers are:

UK +44 207 107 0613 Sweden +46 8 5051 0031 Rest of Europe, +41 58 310 5000 US and Canada +1 866 291 4166 (toll-free) or +1 631 570 5613 (long-distance charges) Lines will be open 10-15 minutes before the start of the call.

ABB (ABBN: SIX Swiss Ex) is a pioneering technology leader in power grids, electrification products, industrial automation and robotics and motion, serving customers in utilities, industry and transport & infrastructure globally. Continuing a history of innovation spanning more than 130 years, ABB today is writing the future of industrial digitalization with two clear value propositions: bringing electricity from any power plant to any plug and automating industries from natural resources to finished products. As title partner in ABB Formula E, the fully electric international FIA motorsport class, ABB is pushing the boundaries of e-mobility to contribute to a sustainable future. ABB operates in more than 100 countries with about 147,000 employees. www.abb.com

This information is information that ABB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out below, at 7:00 A.M CET on December 17, 2018.

Important notice about forward-looking information

This press release includes forward-looking information and statements as well as other statements concerning the outlook for our business. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions, the economic conditions of the regions and industries that are major markets for ABB Ltd. These expectations, estimates and projections are generally identifiable by statements containing words such as “expects,” “believes,” “estimates,” “anticipates”, “targets,” “plans,” “is likely”, “intends”, “aims”, “framework” or similar expressions. However, there are many risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this press release and which could affect our ability to achieve any or all of our stated targets. The important factors that could cause such differences include, among others, business risks associated with the volatile global economic environment and political conditions, costs associated with compliance activities, market acceptance of new products and services, changes in governmental regulations and currency exchange rates and such other factors as may be discussed from time to time in ABB Ltd’s filings with the U.S. Securities and Exchange Commission, including its Annual Reports on Form 20-F. Although ABB Ltd believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

The planned changes might be subject to any relevant engagement processes with local employee representatives/employees. ABB will fully honor any such legal obligations.

1 EV/LTM operational EBITA multiple, operational EBITA calculated using results from twelve-month period to end Q3 2018, before share of corporate cost 2 2014 operational EBITA margin as calculated under old Power Grids portfolio structure 3 Subject to regulatory approvals and fulfillment of closing conditions 4 Post estimated one-time transaction and separation related costs of $500-600 million and cash tax leakage of $800-900 million. Total enterprise value adjustments of ~$3.0 billion, including ~$2.7 billion of net leverage (intercompany loan net of cash transferred) and ~$0.3 billion after-tax unfunded pensions and other liabilities

5 After estimated one-time transaction and separation related costs of $500-600 million and cash tax leakage of $800-900 million. Total enterprise value adjustments of ~$3.0 billion, including ~$2.7 billion of net leverage (intercompany loan net of cash transferred) and ~$0.3 billion after-tax unfunded pensions and other liabilities

6 Post estimated one-time transaction and separation related costs of $500-600 million and cash tax leakage of $800-900 million. Total enterprise value adjustments of ~$3.0 billion, including ~$2.7 billion of net leverage (intercompany loan net of cash transferred) and ~$0.3 billion after-tax unfunded pensions and other liabilities

View source version on businesswire.com: https://www.businesswire.com/news/home/20181216005045/en/

Contacts

ABB Ltd Affolternstrasse 44 8050 Zurich Switzerland Media Relations Phone: +41 43 317 71 11 Email: [email protected]

Investor Relations Jessica Mitchell Phone: +41 43 317 71 11 Email: [email protected]

ABB: Shaping a leader focused in digital industries published first on https://worldwideinvestforum.tumblr.com/

0 notes

Text

ABB: Shaping a leader focused in digital industries

ZURICH — Fundamental actions to focus, simplify and lead in digital industries for enhanced customer value and shareholder returns

Focus of portfolio on digital industries through divestment of Power Grids

Divestment of Power Grids to Hitachi expands existing partnership and strengthens Power Grids as a global infrastructure leader with enhanced access to markets and financing

Enterprise Value of $11 billion for 100% of Power Grids, equivalent to an EV/op. EBITA multiple of 11.2x1

Crystallizing value from the transformation of Power Grids including doubling operational EBITA margin since 20142

ABB initially to retain 19.9 percent in the equity of carved-out Power Grids to ensure transition; pre-defined exit option on 19.9 percent equity at fair market value with floor price at 90 percent of agreed Enterprise Value, exercisable by ABB three years after closing

Closing expected by first half of 20203

ABB intends to return 100% of the estimated net cash proceeds of $7.6-7.8 billion4 from the 80.1% sale to shareholders in an expeditious and efficient manner through share buyback or similar mechanism

Simplification of business model and structure

Discontinuation of legacy matrix structure

Businesses will run all customer-facing activities as well as business functions and territories, fostering ABB’s entrepreneurial business culture

Businesses to be strengthened by transfer of experienced country management resources

Existing country and regional structures including regional Executive Committee roles to be discontinued after closing of the transaction

Corporate activities to be focused on Group strategy, portfolio and performance management, capital allocation, core technologies and ABB Ability™ platform

Shape four leading businesses aligned with customer patterns

All businesses global #1 or #2 in attractive growth markets:

Electrification led by Tarak Mehta

Industrial Automation led by Peter Terwiesch

Robotics & Discrete Automation, a unique combination of B&R and Robotics, led by Sami Atiya

Motion, combining ABB’s market-leading offering in motors and drives, led by Morten Wierod, appointed to Executive Committee as of April 1, 2019

ABB Ability™ tailored digital solutions will drive customer value in each business whilst capturing synergies through common platform

Actions position ABB with a leadership role in digital solutions, and evolving technologies such as artificial intelligence

Financial impact of new ABB

$500 million annual run-rate cost reductions across the group

Approx. $500 million non-operational restructuring charges

New financial framework post-closing defined

New group target framework

Capital allocation priorities unchanged

Dividend policy of rising sustainable dividend per share

ABB intends to maintain the level of dividend per share post close

ABB intends to maintain its long-term “single A” credit rating

Business targets and further financials to be disclosed with strategy update

Strategy update on February 28, 2019, in combination with the Q4 and Full Year 2018 results to provide further details on ABB’s new strategy, businesses and financials

“ABB has been driving industrial change for more than a century as a global pioneering technology leader. As a result of our Next Level strategy, all of our businesses are today number 1 or 2 in their respective markets. To support our customers in a world of unprecedented technological change and digitalization, we must focus, simplify and shape our business for leadership. Today’s actions will create a new ABB, a leader focused in digital industries,” said ABB CEO, Ulrich Spiesshofer.

“Power Grids will strengthen Hitachi as global leader in energy infrastructure and Hitachi will strengthen Power Grids’ position as a global leader in power grids. With this transaction, we are realizing the value we have built through the transformation of Power Grids over the last four years. Our shareholders will directly benefit through the return of the proceeds of the divestment. Building on our existing partnership announced in 2014, the initial joint venture will provide continuity for customers and our global team.”

“To compete in today’s fast-changing world, we fully empower our businesses, through the discontinuation of the legacy matrix structure ensuring zero-distance to customers and increasing our agility in decision-making. Our four newly shaped businesses, each a global leader, will be well aligned to the way our customers operate and focus stronger on emerging technologies such as artificial intelligence. The continued simplification of our business model and structure will be a catalyst for growth and efficiency in our businesses. Our businesses will be further supported through the transfer of experienced resources from today’s country organizations.”

“All of this will only be possible due to the commitment of our global team who has made ABB what it is today. Our innovation power together with our inclusive culture will continue to be a differentiating strength of our company. We will live enhanced customer focus, provide attractive opportunities for our employees and deliver value for shareholders.”

Peter Voser, Chairman of ABB, said, “Today´s announcement marks the beginning of a new chapter in ABB´s history. Building on our technology and global talented employee base we will further strengthen our focus in digital industries, delivering competitive returns for shareholders, including our committed dividend policy. Over the past five years the deliberate execution of ABB’s strategy laid the foundation for our businesses to compete in the fast changing digital industries and deliver profitable growth.”

“We were very clear in the past that the actions required for the turnaround of Power Grids could be best achieved within ABB. Following completion of this step, we undertook a review of the Power Grids business and decided to secure the best home for the future development of the business through the combination with Hitachi. The new ABB will be positioned to write the future as a customer focused technology leader in digital industries.”

Focus of portfolio on digital industries through divestment of Power Grids

ABB announces today that Hitachi will acquire ABB’s Power Grids business, an expansion of its existing partnership with Hitachi. The agreed price represents a transaction Enterprise Value of $11 billion for 100 percent of Power Grids, the equivalent to an EV/op. EBITA multiple of 11.2x1, before share of corporate cost. ABB will initially realize a levered consideration of ~$9.1 billion from the sale of 80.1 percent of Power Grids, including pre-sale net leverage (intercompany loan net of cash transferred), before one-time transaction and separation related costs as well as cash tax impacts.

In the fast-changing world of energy infrastructure, with a shifting customer landscape and the need for financing and increased government influence, ABB believes Hitachi is the best owner for Power Grids. As a stable and long-term committed owner, with whom ABB has developed a strong business partnership since 2014, Hitachi will further strengthen the business, providing it with access to new and growing markets as well as financing. Hitachi will accelerate Power Grids to the next stage of its development, building on the solid foundation achieved under ABB’s previous ownership.

Since 2014, Power Grids has been significantly improved under the ownership of ABB. The latest results (Q3 2018) are at the target margin corridor, having more than doubled margins, with positive third party base order development recorded for the last six consecutive quarters.

ABB will initially retain a 19.9 percent equity stake in the joint venture, allowing a seamless transition. The transaction agreement includes a pre-defined option for ABB to exit the retained 19.9 percent share, exercisable three years after closing, at fair market value with floor price at 90 percent of agreed Enterprise Value. Hitachi holds a call option over the remaining 19.9 percent share at fair market value with floor price at 100 percent of agreed Enterprise Value.

The joint venture will be headquartered in Switzerland, with Hitachi retaining the management team to ensure business continuity.

Starting in Q4 2018 until closing, ABB will report Power Grids in discontinued operations. As a consequence, ABB will record $350-400 million of stranded and other carve-out related costs, which are currently predominately recorded as part of the Power Grids cost base. These will now be recognized in ABB’s corporate & other operational EBITA. ABB expects to eliminate the vast majority of these costs by deal closing by transferring them back to Power Grids. ABB expects approximately $200 million of charges in Q4 2018 related predominantly to the legacy EPC substation business reported in non-core corporate & other operational EBITA.

ABB expects to incur one-time non-operational transaction and separation related costs of $500-600 million. ABB anticipates $800-900 million related cash tax impact. The completion of the transaction is expected by first half of 2020, subject to regulatory approvals and fulfillment of closing conditions. ABB intends to return 100 percent of the estimated net cash proceeds of $7.6-7.8 billion5 from the 80.1 percent sale to shareholders in an expeditious and efficient manner through share buyback or similar mechanism.

Simplification of business model and structure

Effective April 1, 2019, ABB will simplify its organizational structure through discontinuation of the legacy matrix structure, thereby empowering its four leading businesses to serve customers even better, while further sharpening responsibilities and increasing efficiency.

ABB’s new organization will provide each business with full operational ownership of products, functions, R&D and territories. The businesses will be the single interface to customers, maximizing proximity and speed.

The corporate center will be further streamlined. It will set the long-term vision and strategy for the group, guided by ABB’s values. It will drive capital allocation, portfolio and performance management, core technologies ABB Ability™, ABB’s brand and investment in people. As a key building block of the simplification, existing country and regional structures including regional Executive Committee roles will be discontinued after the closing of the transaction. Existing resources from country level will strengthen the new businesses. ABB expects a total of $500 million annual run-rate cost reductions across the group over the medium-term. Approximately $500 million of related non-operational restructuring charges are expected to be taken over the coming two years.

Shape four leading businesses aligned with customer patterns

ABB will shape four customer-focused, entrepreneurial businesses – Electrification, Industrial Automation, Robotics & Discrete Automation and Motion. Each business will be either the global #1 or #2 player in attractive markets with strong secular drivers. ABB’s established domain know-how, world-class engineering and technology expertise, will position the four businesses well to deliver innovative products and solutions for enhanced customer value. ABB’s addressable market is growing by 3.5-4 percent per annum, adding $140 billion in size to reach $550 billion by 2025.

Based on ABB’s common digital platform ABB Ability™, the businesses will provide tailored digital solutions, driving enhanced customer value. Building on emerging technologies including artificial intelligence and its strong software offering, ABB Ability™ will meet the increasing demand from ABB’s customers for digital solutions in the rapidly changing industrial world.

Electrification – writing the future of safe, smart and sustainable electrification

The existing business will provide a complete portfolio of innovative products, digital solutions and services from substation to socket. With a #2 market position globally, its addressable market is presently $160 billion and will grow on average around 3 percent per annum over the long-term. The Electrification business will have strong exposure to rapidly growing customer segments including renewables, e-mobility, data centers and smart buildings. The business will be led by Tarak Mehta, currently president of the Electrification Product division. The Electrification business would have generated approximately $13 billion of revenues in the twelve-month period to end September 2018, including an estimated revenue contribution across the period from GEIS, a business that was acquired June 30, 2018.

Industrial Automation – writing the future of safe and smart operations

The newly shaped business will offer a complete range of innovative solutions enabling customers to operate safe and energy-efficient processes with increasing autonomy. Industrial Automation will include ABB’s industry-specific integrated automation, electrification and digital solutions, control technologies, software and advanced services, as well as measurement & analytics, marine, and turbo-charging offerings. Industrial Automation will be #2 in the market globally. The addressable market of $90 billion is expected to grow on average by 3-4 percent per annum over the long-term. The business will be led by Peter Terwiesch, currently president of the Industrial Automation division. Industrial Automation would have generated approximately $7 billion of revenues in the twelve-month period to end September 2018.

Robotics & Discrete Automation – writing the future of flexible manufacturing and smart machines

The newly shaped business will uniquely combine machine and factory automation solutions, mainly from B&R, with the most comprehensive robotics solutions and applications suite in the market. The business will be #2 globally, with a #1 position in robotics in the important, high-growth Chinese market. The addressable market, already $80 billion in size, is anticipated to grow on average at 6-7 percent per annum over the long-term. The businesses digital solutions and services provide customers with enhanced safety, efficiency, up-time and speed, and cater to the growing customer demand for flexible and integrated manufacturing solutions. Robotics & Discrete Automation will be led by Sami Atiya, currently president of the Robotics and Motion division. Robotics & Discrete Automation would have generated approximately $4 billion of revenues in the twelve-month period to end September 2018.

Motion – writing the future of smart motion.

The business will provide customers with a comprehensive range of innovative electrical motors, generators, drives, and service, as well as integrated digital powertrain solutions. Motion will be the #1 player in the market globally, with the largest installed base in an $80 billion market that grows on average around 3 percent per annum. The business will be led by Morten Wierod, currently Managing Director Business Unit Drives. He will become a member of the Executive Committee effective

April 1, 2019. Motion would have generated approximately $6 billion of revenues in the twelve-month period to end September 2018.

Attractive financial profile

ABB will demonstrate improved commercial quality of business, enhanced exposure to faster growing markets, with a greater emphasis on high value-add solutions, less large order volatility and more recurrent revenues through digital solutions, software and services.

ABB’s investment proposition is reflected in a new medium-term group target framework:

3-6 percent annual comparable revenue growth

operational EBITA margin of 13-16 percent

Return on Capital Employed (ROCE) of 15-20 percent

Cash conversion to net income of approximately 100 percent, and

Basic EPS growth above revenue growth

ABB would have generated revenues of approximately $29 billion in the twelve-month period to end September 2018, including an estimated revenue contribution across the period from GEIS, a business that was acquired June 30, 2018, and excluding Power Grids contribution.

Capital allocation

ABB’s sustained capital allocation priorities are unchanged, namely:

fund organic growth, R&D and capex to yield attractive returns

rising sustainable dividend

value-creating acquisitions

returning additional cash to shareholders

Following completion of the divestment of Power Grids, ABB intends to return 100 percent of the net cash proceeds6 to shareholders in an expeditious and efficient manner and execute a policy of a rising sustainable dividend. ABB intends to maintain the level of dividend per share post close and aims to maintain its “single A” credit rating long term.

Strategy update

ABB intends to host a strategy update alongside the Q4 2018 results. At the strategy update, ABB’s leaders and management teams of the four business areas will provide detailed overviews of their markets, strategies, businesses and targets.

Revised dates

In light of these fundamental changes, ABB will amend the announced dates for:

Q4 and FY 2018 results to February 28, 2019

Q1 2019 and the AGM to May 2, 2019

Credit Suisse AG and Dyal Co. LLC acted as financial advisors, and Freshfields Bruckhaus Deringer LLP as legal advisors, to ABB.

More information

For further information on today’s announcement, please see ABB.com/writing-the-future.

ABB will host a press conference today starting at 10:00 a.m. Central European Time (CET) (9:00 a.m. BST, 4:00 a.m. EDT). The event will be accessible by webcast on https://swisscomstream.ch/abb/20181217/en

ABB will host a conference call for analysts and investors, starting at 2:00 p.m. Central European Time (CET) (1:00 p.m. GMT, 8:00 a.m. EST). The call will be available to join via webcast https://swisscomstream.ch/abb/20181217/en

The event will be accessible by conference call. Callers are requested to phone in 10 minutes before the start of the call. The analyst and investor conference call dial-in numbers are:

UK +44 207 107 0613 Sweden +46 8 5051 0031 Rest of Europe, +41 58 310 5000 US and Canada +1 866 291 4166 (toll-free) or +1 631 570 5613 (long-distance charges) Lines will be open 10-15 minutes before the start of the call.

ABB (ABBN: SIX Swiss Ex) is a pioneering technology leader in power grids, electrification products, industrial automation and robotics and motion, serving customers in utilities, industry and transport & infrastructure globally. Continuing a history of innovation spanning more than 130 years, ABB today is writing the future of industrial digitalization with two clear value propositions: bringing electricity from any power plant to any plug and automating industries from natural resources to finished products. As title partner in ABB Formula E, the fully electric international FIA motorsport class, ABB is pushing the boundaries of e-mobility to contribute to a sustainable future. ABB operates in more than 100 countries with about 147,000 employees. www.abb.com

This information is information that ABB is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out below, at 7:00 A.M CET on December 17, 2018.

Important notice about forward-looking information

This press release includes forward-looking information and statements as well as other statements concerning the outlook for our business. These statements are based on current expectations, estimates and projections about the factors that may affect our future performance, including global economic conditions, the economic conditions of the regions and industries that are major markets for ABB Ltd. These expectations, estimates and projections are generally identifiable by statements containing words such as “expects,” “believes,” “estimates,” “anticipates”, “targets,” “plans,” “is likely”, “intends”, “aims”, “framework” or similar expressions. However, there are many risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking information and statements made in this press release and which could affect our ability to achieve any or all of our stated targets. The important factors that could cause such differences include, among others, business risks associated with the volatile global economic environment and political conditions, costs associated with compliance activities, market acceptance of new products and services, changes in governmental regulations and currency exchange rates and such other factors as may be discussed from time to time in ABB Ltd’s filings with the U.S. Securities and Exchange Commission, including its Annual Reports on Form 20-F. Although ABB Ltd believes that its expectations reflected in any such forward-looking statement are based upon reasonable assumptions, it can give no assurance that those expectations will be achieved.

The planned changes might be subject to any relevant engagement processes with local employee representatives/employees. ABB will fully honor any such legal obligations.